Research has shown that U.S. adults tell an average of one to two lies per day. With COVID-19 and our expanding reliance on a digital workplace, fraud is on the rise and expected to continue. Fraud is more than making up a white lie to get out of an after-hours work event; it is the intention to deceive. It can be anything from misleading or untruthful financial reporting to the embezzlement of donor dollars. So how do you protect your nonprofit organization from increasing internal fraud? There are three things you need to know now:

- Why employees commit fraud

- How to spot signs of internal fraud

- Best practices for internal fraud prevention

Why Employees Commit Fraud

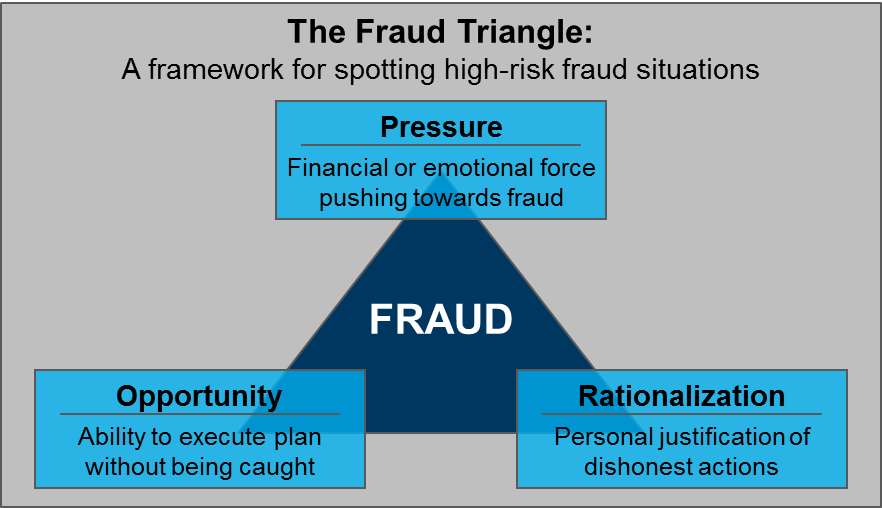

Research from renowned criminologist, Donald Cressey, revealed that individuals tend to commit fraud when a combination of three factors are present: 1) pressure, 2) opportunity and 3) rationalization. Together, this dangerous trifecta is known as the Fraud Triangle.

Whether motivated internally to please a CEO and meet board expectations or brought on by external factors like personal financial troubles or serious life changes, all fraud begins with someone feeling an actual or perceived pressure. A recent survey from the Association of Certified Fraud Examiners found that the largest increase in observed fraud at the end of 2020 was financial statement fraud, likely due to organizations feeling pressure to “cook the books” as revenue has declined or been affected by the pandemic.

Opportunity is identifying an action that you believe would benefit you personally, professionally or organizationally that could be done without getting caught. People who are dissatisfied with their jobs are more likely to commit fraud. This is the only part of the fraud triangle leaders or organizations can control by implementing adequate internal fraud controls (more on that in a minute).

Finally, people who commit fraud convince themselves that it is OK to do so, aka rationalization. They tell themselves that their reasons for committing fraud warrant the action or that it “isn’t that big of a deal,” or “I’ll pay it back next week.”

13 Warning Signs of Internal Fraud

Many leaders are shocked when they learn one of their employees is committing fraud. Here are some common signs of internal fraud you should be aware of so you can spot them right away.

- Incomplete or undetailed bookkeeping/accounting records

- Missing or altered documentation in financial reports

- Excessive/unexplained journal entries

- Sloppy records or out-of-balance accounts

- Employee provides copies of invoices rather than original documents

- Unexplained adjustments to accounts receivable of accounts payable

- Large unexplained inventory shortages

- Frequent cash shortages/overages

- Employee provides unreasonable explanations when questioned

- Personal employee financial problems

- Employees living beyond their means

- Staff working excessive, unexplained overtime

- Customer/vendor insisting on working with only one employee

Best Practices for Internal Fraud Prevention

The most important deterrent to fraud is putting internal controls in place. Here are a few best practices for internal fraud prevention at your nonprofit.

1. Separate important roles.

In its simplest form, effective internal fraud controls require separating tasks associated with authorizing financial decisions, recording financial activity and managing assets. Separating these critical roles prevents one person from having too much control over any one part of the process and creates a system of natural checks and balances.

For small organizations with limited employees, hire a certified public accountant designated as a certified fraud examiner (CFE) to conduct an independent review of detailed or select transactions and bank reconciliations. You can also consider utilizing your board treasurer to act as an independent reviewer. (Not sure what that means? You need this.)

2. Ask questions.

The most significant deterrent to fraud is making people aware that someone is watching by asking questions. Be curious and don’t assume everything is working correctly.

3. Don’t allow yourself to “not know.”

One of the common things we hear when investigating fraud cases is nonprofit executive directors, CEOs and/or board members saying they didn’t know what they were looking at or didn’t understand the details of bank reconciliations and accounting basics. Board members and senior leaders have a fiduciary responsibility to ensure business transactions are legal and assets are protected.

To better understand your organization’s financials and protect its assets, take a specialized training class or certificate program specific to nonprofit financial management, like the Nonprofit Leadership Center’s Certificate in Nonprofit Financial Management.

Here are some other things you should be doing to avoid fraud (and surprises):

- Review invoices

- Review employee reimbursements

- Review payroll reports

- Limit accountant authority

- Review significant contributions for donor restrictions

- Analyze donor-restricted contributions

- Reconcile the donor database to the general ledger

- Review monthly bank statements outside of the accounting department

- Create a month-end close checklist

- Review financial statements

By understanding why employees commit fraud, knowing the common signs of internal fraud and implementing best practices for internal fraud prevention, you can take critical steps to protect your nonprofit and secure a successful future for your organization.

Avoid Internal Fraud by Getting Your Certificate in Financial Management

The Nonprofit Leadership Center offers a Certificate in Nonprofit Financial Management to provide nonprofit leaders with the basic skills and knowledge needed to establish and maintain strong financial management of your organization. With a focus on best practices, courses will strengthen your ability to make sound decisions that affect your nonprofit’s programs and operations. They will demystify financial jargon and teach you about financial record-keeping. Course material uses easily understood and relevant case examples as well as engaging, interactive explanations for financial terminology, assumptions and concepts.